missouri employer payroll tax calculator

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Discover ADP For Payroll Benefits Time Talent HR More.

Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI.

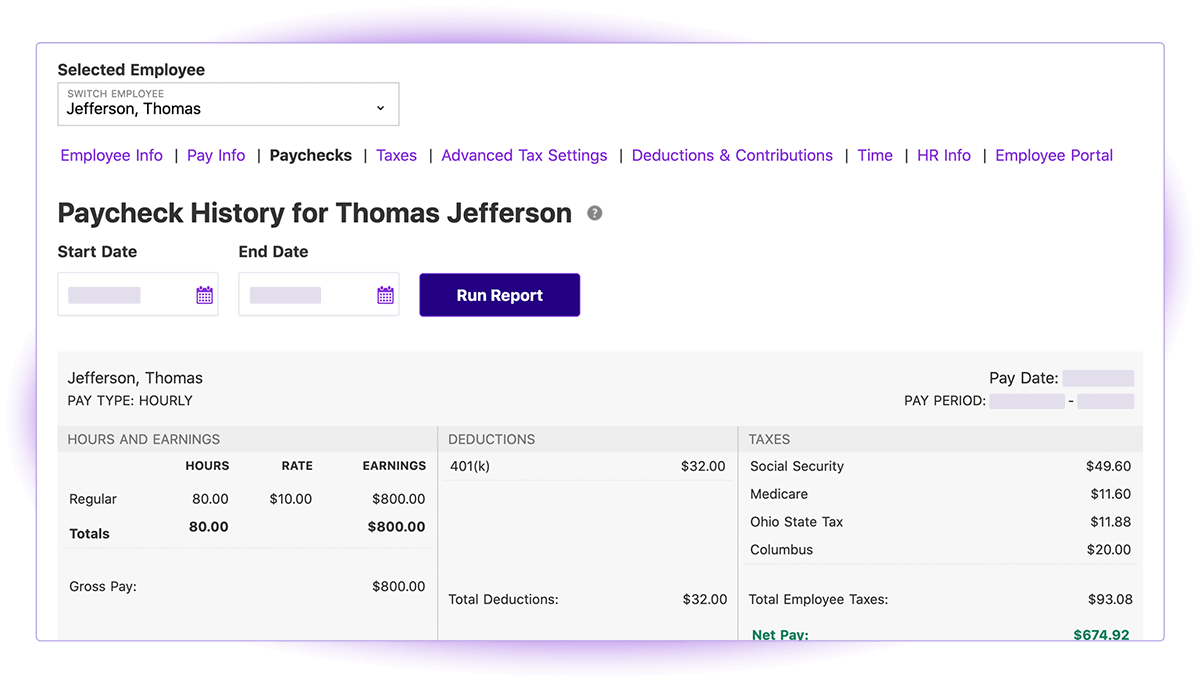

. Missouri is currently not a credit reduction state. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

That tax rate hasnt changed since 1993. Missouri Payroll for Employers. Missouri Cigarette Tax.

It is not a substitute for the advice of. Get Started With ADP. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

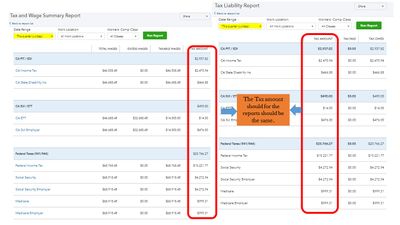

Additions to Tax and Interest Calculator. All corporations and manufacturers doing business in the state. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

Get Started With ADP. The Missouri Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Missouri State. The standard FUTA tax rate is 6 so your max.

Withhold 62 of each employees taxable wages until they earn gross pay. Missouri Hourly Paycheck Calculator. Employees with multiple employers may refer to.

Employers covered by Missouris wage payment law must pay wages at least semi-monthly. Employers can use the calculator rather than manually looking up. Then you are probably looking for a fast and accurate solution to calculate your employees pay.

Taxes to withhold Your Missouri State Taxes to withhold are Need to adjust your withholding amount. Ad Process Payroll Faster Easier With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. There are Kansas City earnings taxes of 1 that are withheld from the.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only. Local taxes are imposed in Missouri. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Discover ADP For Payroll Benefits Time Talent HR More. Check if you have multiple jobs. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Missouri Salary Paycheck Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Complete an updated MO W-4 and submit to your employer.

Missouri does not have any reciprocal agreements with other states. Number of Qualifying Children under Age 17. Our paycheck calculator for employers makes the payroll process a breeze.

Important note on the salary paycheck calculator. Ad Process Payroll Faster Easier With ADP Payroll.

Employer Payroll Tax Calculator Incfile Com

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Do Payroll In Excel In 7 Steps Free Template

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Employer Payroll Taxes What They Are And How They Work Adp

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

What Is Local Income Tax Income Tax Income Tax

2022 Federal Payroll Tax Rates Abacus Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Solved Employer Payroll Tax Expense Account

Employer Payroll Tax Calculator Incfile Com

2022 Federal State Payroll Tax Rates For Employers